15% Stake to Vodacom at KSh 34 – Parliament Calls for Public Input

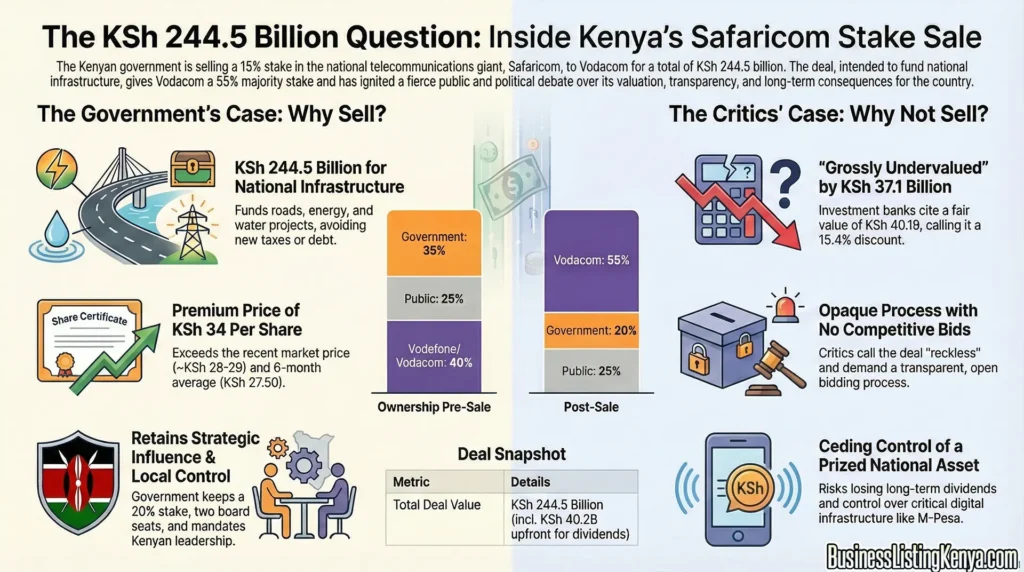

The Kenyan government plans to sell its 15% stake in Safaricom PLC (about 6.01 billion shares) to Vodacom Group via Vodafone Kenya Limited at KSh 34 per share, valuing the block at KSh 204.3 billion (~USD 1.6 billion). (1, 2)

In the Safaricom shares sale, Vodacom will also pay KSh 40.2 billion upfront for future dividends on the government’s remaining 20% stake, totaling KSh 244.5 billion for infrastructure funding. (3)

Post-sale ownership: Vodacom at 55% (up from 35%, plus 5% from Vodafone), the government at 20% (with board seats), and the public at 25%. (1)

✅ Why Supporters Back the Safaricom Shares Sale

- Unlocks cash from a mature asset: Treasury calls it optimal value from a stable earner, avoiding debt/taxes for roads, energy, water, airports via National Infrastructure Fund. (4)

- Premium pricing: KSh 34 exceeds the recent NSE price (~KSh 28-29 as of December 2025) and the 6-month average (KSh 27.50), paid in USD to boost reserves. (5)

- Retains influence: Government keeps strategic stake/board role; Safaricom stays NSE-listed with Kenyan foundation trustees. (1)

⚠️ Critics Slam “Undervalued” Safaricom Sale as Goose-Killing Move

- 15.4% discount flagged: Standard Investment Bank values shares at KSh 40.19 fair value, saying sale leaves KSh 37.1 billion on the table vs. 2021 peaks (~KSh 45). (2)

- No open bids: Kiharu MP Ndindi Nyoro demands a competitive process, calls it “a raw deal,” like “selling a developed plot cheap,” ties to opaque borrowing (e.g., Sh175B fuel levy mortgage). (6)

- Strategic risks: Ceding control over M-Pesa/digital infra to a foreign firm threatens sovereignty; sets precedent for other SOEs. (1)

| Aspect | Pro-Sale Argument (7) | Critics’ Concern (2, 6) |

|---|---|---|

| Price | Premium to market (KSh 28-29) | 15.4% below fair value (KSh 40) |

| Process | Low-risk to partner like Vodacom | No bids, rushed, non-staff negotiators |

| Impact | Funds infra, USD boost | Loses dividends/taxes long-term |

Parliament Public Participation: Submit by Jan 8, 2026

The National Assembly opened input on Sessional Paper No. 3 of 2025 per the Constitution, amid backlash.

Kenyans, shareholders can submit memoranda to guide committees; deal eyes Q1 2026 close with 9 govt conditions (e.g., local M-Pesa focus).

Nyoro & others decry it as “too late” post-negotiation.

Safaricom Shares Sale FAQs

1. What is the Kenyan government selling in the Safaricom deal?

The government plans to sell its 15% stake (about 6.01 billion shares) in Safaricom PLC to Vodacom Group via Vodafone Kenya Limited at KSh 34 per share, valued at KSh 204.3 billion, plus KSh 40.2 billion upfront for future dividends on the remaining 20% stake, totaling KSh 244.5 billion. (1)

2. Is the sale price fair or undervalued?

Supporters claim KSh 34 is a premium over the recent NSE price (~KSh 28-29), and 6-month average (KSh 27.50), but critics like Standard Investment Bank call it a 15.4% discount to fair value (KSh 40.19), potentially leaving KSh 37.1 billion on the table. (2)

3. When does public participation end, and what happens next?

Parliament invites memoranda on Sessional Paper No. 3 of 2025 until January 8, 2026, for committee review; the deal targets Q1 2026 closure with government conditions like local M-Pesa focus amid ongoing backlash from figures like Ndindi Nyoro. (6)

Related article: Safaricom Profits Exceed Estimates Despite Losses in Ethiopia